Housing Loan Agreement

Contract No.: _________________________

Place of Signing: ______________________

Date of Signing: ____ / __ / ____

Article 1. Parties to the Agreement

Party A (Lender): ___________________________

Unified Social Credit Code / Business License No.: _______________________

Registered Address: _________________________________________________

Contact Person & Contact Information: _________________________________

Party B (Borrower): ___________________________

ID Card No. / Passport No.: _______________________

Address: _________________________________________________

Contact Information: _________________________________

Article 2. Loan Amount and Purpose

- Loan Amount: RMB ______ (or USD ______).

- Purpose of Loan: Party B undertakes to use the loan exclusively for the purchase of the property located at: _______________________, and shall not divert the funds for other purposes.

Article 3. Loan Term

- Start Date: ____ / __ / ____.

- Maturity Date: ____ / __ / ____.

- Loan Term: ______ years/months, commencing from the actual date of disbursement.

Article 4. Interest Rate and Fees

- Interest Rate: Annual rate ______% (or monthly rate ______%), calculated on an actual day basis.

- Service Fee and Other Charges (if applicable): RMB ______ or equivalent costs.

- Payment of Interest and Fees: □ Monthly □ Quarterly □ Other agreed method: _______________________.

Article 5. Repayment Method

- Repayment Method:

- □ Equal principal and interest

- □ Equal principal

- □ Lump sum repayment of principal and interest

- □ Other: _______________________

- Repayment Account (designated by Party A):

- Bank Name: _______________________

- Branch: _______________________

- Account Holder: _______________________

- Account Number: _______________________

- Party B shall make repayment of principal and interest on schedule to the above-designated account.

Article 6. Property Mortgage

- To secure the performance of this Agreement, Party B agrees to mortgage the purchased property, with mortgage registration at: _______________________.

- The scope of the mortgage includes the principal, interest, and any costs arising from default.

- Mortgage registration fees shall be borne by ______ (Party A / Party B).

- Without Party A’s prior written consent, Party B shall not transfer, lease, or re-mortgage the property.

Article 7. Early Repayment

- Party B may repay all or part of the loan in advance. Interest shall be calculated based on the actual days of loan usage.

- Early repayment requires ____ days’ prior written notice to Party A and confirmation of the settlement amount by both parties.

Article 8. Rights and Obligations of the Parties

- Party A (Lender):

- Provide the loan in accordance with this Agreement;

- Collect interest and fees as agreed;

- Supervise the use of the loan to ensure it is used for purchasing the property.

- Party B (Borrower):

- Use the loan strictly for the agreed purpose;

- Repay principal and interest on schedule;

- Cooperate with Party A in mortgage registration and loan supervision.

Article 9. Liability for Breach of Contract

- Overdue Repayment: If Party B fails to repay on time, a penalty of ______% per day shall be applied to the overdue portion. Party A has the right to demand immediate repayment of the entire loan and interest.

- Any collection costs, litigation costs, and related expenses due to Party B’s default shall be borne by Party B.

- If Party A fails to provide the loan as agreed, Party A shall bear the corresponding liability.

- If Party B violates the mortgage provisions, Party A has the right to dispose of the mortgaged property in accordance with the law to recover the loan.

Article 10. Dispute Resolution

- This Agreement shall be governed by the laws and regulations of the place of signing.

- Any disputes arising during the performance of this Agreement shall first be resolved through negotiation; if negotiation fails, either party may submit the dispute to the arbitration commission or the People’s Court at the place of signing.

Article 11. Miscellaneous

- Matters not covered in this Agreement shall be supplemented in writing, and such supplements shall have the same legal effect as this Agreement.

- This Agreement is executed in two (2) originals, with each party holding one, and shall take effect upon signing and/or sealing by both parties.

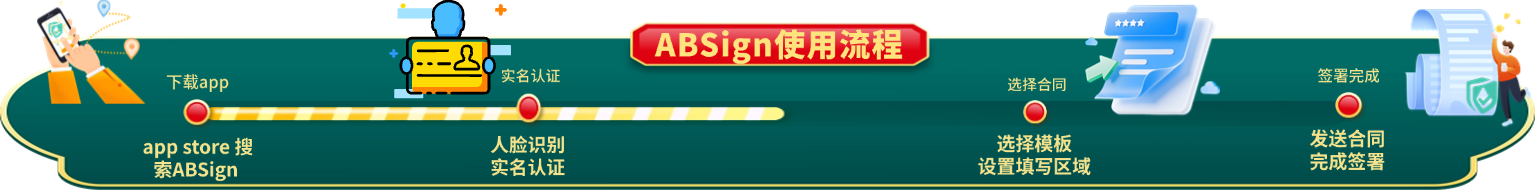

- Both parties confirm that electronic signatures and paper signatures are equally valid.

Signatures

Party A (Lender): ___________________ (Seal/Signature)

Date: ____ / __ / ____

Party B (Borrower): ___________________ (Signature)

Date: ____ / __ / ____